Let’s get one thing straight: blockchain technology is basically a shared, unchangeable digital notebook. Think about it like this: every time something new happens—a transaction, a record, any piece of data—it gets written down on a new page. This “page” is called a block.

Once the page is full, it’s sealed shut with a special cryptographic lock and attached to the page before it, creating a permanent chain. Then, a copy of this entire, ever-growing notebook is given to everyone in the network. It’s a simple idea, but it creates a chain of records that’s transparent and almost impossible to mess with.

What Is Blockchain Technology and Why Does It Matter?

At its core, blockchain tackles a massive question we all face online: how can we trust anything without a middleman? We’re used to relying on banks, governments, or big tech companies to verify who we are and what we do. They hold the keys to the kingdom, managing our data and keeping the official records.

Blockchain offers a completely different way. Instead of one company controlling the “official” copy of the notebook, it hands out identical copies to a huge network of computers. This is decentralization, and it means no single person or group can secretly change the records, delete a transaction, or shut the whole thing down. Everyone in the network plays a part in keeping the ledger honest.

The Origins of Blockchain

This whole idea exploded onto the scene in 2008 when an anonymous figure (or group) called Satoshi Nakamoto published the famous Bitcoin whitepaper. It laid out blockchain as the engine that would power the world’s first cryptocurrency. The formal definition is that blockchain is a decentralized digital ledger that records transactions across countless computers, making sure that once data is in, it can’t be changed without everyone agreeing. You can find more about the emergence of blockchain technology on binariks.com for a deeper historical dive.

But while Bitcoin put blockchain on the map, the technology itself is useful for so much more than digital cash. It’s a secure foundation for everything from tracking luxury goods on a supply chain to building tamper-proof voting systems.

Understanding the Core Principles

So, what really makes blockchain tick? It all comes down to a few key ideas that work together to build a system based on security, transparency, and trust baked right into the code.

To get a quick handle on these concepts, here’s a simple breakdown of what makes a blockchain, a blockchain.

Blockchain at a Glance: Key Characteristics

| Characteristic | Simple Explanation |

|---|---|

| Decentralization | The record book isn’t stored in one place. It’s copied and spread across many computers, so there’s no single point of failure. |

| Immutability | Once a record (a block) is added to the chain, it can’t be changed or deleted. It’s like writing in permanent ink. |

| Transparency | While your real identity can be hidden, all transactions on the ledger are visible to everyone on the network. No secrets. |

| Security | Powerful cryptography links the blocks together. This makes it incredibly hard for anyone to tamper with old records without being instantly caught. |

These core features create a system where you don’t have to trust an institution; you just have to trust the math and the network. It’s a fundamental shift in how we think about digital agreements, and it’s why blockchain has the potential to shake up so many industries. In the next few sections, we’ll pull back the curtain and see exactly how all these pieces fit together.

The Core Components That Make Blockchain Work

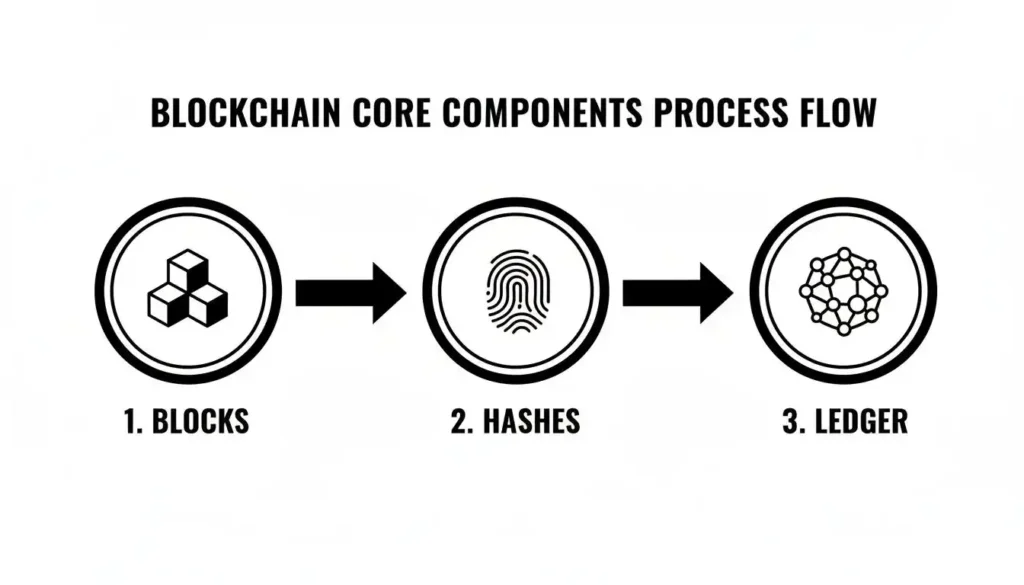

To really get what blockchain is all about, you have to look under the hood. Like any car, a blockchain has a few key parts that work together to make it go. These aren’t just technical details; they’re the very foundation of how this technology builds trust and security without needing a central company or bank in charge.

Let’s pull back the curtain on the three most important pieces: the blocks themselves, the cryptographic hashes that act like digital wax seals, and the distributed ledger that makes sure everyone is on the same page. Once you see how these fit together, the whole idea of an unchangeable, shared history clicks into place.

The Anatomy of a Block

Imagine a block as a single page in a tamper-proof digital notebook. It isn’t just a jumble of information; each one is carefully structured to hold specific, vital data.

- Transaction Data: This is the meat and potatoes. It’s a bundle of recent, verified transactions—anything from cryptocurrency payments and contract agreements to updates on a product’s journey through a supply chain.

- A Timestamp: Every single block is stamped with the precise time it was created. This creates a clear, chronological order, stopping anyone from trying to spend the same money twice and building a verifiable timeline of events.

- A Unique Identifier (The Hash): Think of this as a block’s unique fingerprint. A hash is a complex, one-of-a-kind code that identifies the block and everything inside it.

Here’s the clever part: each new block also contains the unique hash of the block that came right before it. This is literally the “chain” in blockchain. By embedding the previous block’s fingerprint, it forges a secure, cryptographic link that’s incredibly tough to break. If you tried to alter an old block, its hash would change, instantly breaking the chain that follows. The entire network would immediately spot the tampering.

Key Takeaway: A block is a secure, time-stamped package of transactions that is cryptographically chained to the one before it, creating a permanent and unbreakable record.

Cryptographic Hashes: The Digital Wax Seal

So, what exactly is this hash thing? A cryptographic hash is generated by a clever algorithm that can take any amount of data—a single word, a photo, or a whole library of books—and crunch it down into a fixed-length string of characters.

Think of it like a high-tech fingerprint generator for data. No matter how much information you put in, the fingerprint (the hash) always comes out the same size. This process has two key features that make blockchain so secure:

- It’s a one-way street: It’s super easy to create a hash from data, but it’s virtually impossible to work backward and figure out the original data just by looking at the hash.

- It’s hyper-sensitive: The tiniest change to the input data—even switching a single comma to a period—will produce a completely different hash.

This extreme sensitivity is what makes the blockchain effectively unchangeable. If a bad actor tried to edit just one small detail in a past transaction, the block’s hash would change. Since that hash is baked into the next block, its hash would also have to change, setting off a domino effect that would shatter the entire chain.

The Distributed Ledger: Everyone Holds a Copy

The final piece of the puzzle is the distributed ledger. The concept is simple but incredibly powerful. Instead of one person or company holding the official notebook, an identical copy is shared and synchronized across a huge network of computers, which we call nodes.

This means there’s no single point of failure or control. A PwC report estimates blockchain could add $1.76 trillion to the global economy by 2030, largely because this distributed model gets rid of the need for expensive middlemen.

When a new block of transactions is confirmed, it’s broadcast to every node on the network. Each node then independently checks the block and adds it to its own copy of the ledger. This process of reaching an agreement keeps everyone’s records identical. It’s what makes the entire system transparent, resilient, and fundamentally democratic.

How a Blockchain Transaction Actually Happens

Knowing the building blocks is one thing, but seeing how they all fit together is where the magic happens. Let’s walk through the entire lifecycle of a single transaction to make this all feel a bit more concrete.

Imagine you’re sending some digital cash to a friend. That simple click kicks off a surprisingly elegant and secure chain of events across the entire network, all starting the moment you hit “send.”

Step 1: Kicking Off the Transaction

First, you authorize the payment from your digital wallet. This is done by creating and signing a transaction request with your private key—a secret, cryptographic code that acts as your unforgeable signature, proving you own the funds.

Think of it like signing a check, but in the digital realm. This request, which includes your friend’s address and the amount, is then broadcast out to the entire peer-to-peer network. Every computer (node) on that blockchain gets the message.

Step 2: The Network Validates Your Request

Now, the global network of nodes gets to work. Computers from all over the world pick up your broadcast and start running checks to make sure everything is on the level.

- Verifying Ownership: Nodes use your public key (which is linked to your private one) to confirm your digital signature is legit and that your account actually has the funds you’re trying to send.

- Checking the Rules: They also ensure the transaction follows the blockchain’s rules. This is critical for preventing things like “double-spending,” where someone sneakily tries to send the exact same digital coin to two different people.

Instead of a single bank having the final say, this decentralized validation process relies on a global community of verifiers. It’s this collective oversight that makes the system so incredibly secure and trustworthy.

The diagram below shows how these core pieces come together.

This visualizes how individual transactions get bundled into blocks, sealed with a unique hash, and then added to the shared ledger for everyone to see.

Step 3: A New Block Is Born

Once your transaction is verified, it doesn’t just instantly appear on the blockchain. Instead, it gets tossed into a “mempool”—basically a digital waiting room filled with other recently validated transactions.

From this pool, specialized nodes (often called miners or validators, depending on the system) scoop up a bunch of these pending transactions and bundle them together into a brand-new, unconfirmed block. But before this block can be officially added, the entire network has to agree that it’s valid.

Step 4: Reaching Consensus and Locking It In

This is the most important part of the whole process: reaching consensus. The network needs a way to agree on which new block gets to be the next link in the chain. This is handled by a consensus mechanism—a set of rules that ensures everyone agrees on the same version of the truth.

The most famous mechanism is Proof-of-Work (PoW), the system that powers Bitcoin. Miners compete to solve an incredibly difficult mathematical puzzle. The first one to crack it gets the right to add their block to the chain and earns a reward for their computational effort.

A more energy-efficient and popular alternative is Proof-of-Stake (PoS). In this model, validators are chosen to create new blocks based on how many coins they hold and are willing to “stake” as collateral. It’s much faster and uses a fraction of the electricity.

The constant push for speed and efficiency has led to some incredible innovation here. Solana, for example, is known for its blistering speed, capable of handling 65,000 transactions per second (TPS). That’s a world away from Ethereum’s 15 TPS, and it’s this kind of performance that has helped DeFi applications process over $1 trillion in volume. You can find more analysis in the 2026 crypto outlook on trakx.io.

Once consensus is reached, the new block is sealed with its own unique hash, cryptographically linked to the block before it, and broadcast to the entire network. Every node adds this new block to their copy of the ledger. And just like that, your transaction is complete—permanently and transparently recorded for all time.

Exploring Different Types of Blockchain Networks

Just like the internet isn’t one monolithic thing—you have the open web, but also private corporate intranets—blockchain technology isn’t a one-size-fits-all solution. Different problems call for different kinds of networks, each with its own set of rules about who can get in and what they’re allowed to do.

The main difference really boils down to a single question: who gets to participate? The answer to that question splits the blockchain universe into three main flavors: public, private, and consortium. Each one offers a unique trade-off between transparency, security, and control, making them suited for completely different jobs.

Public Blockchains: The Global Library

A public blockchain is exactly what it sounds like—wide open for everyone. Think of it as a global public library. Anyone with an internet connection can walk in, read every book on the shelves, and even propose adding a new one to the collection.

Networks like Bitcoin and Ethereum are the most famous examples.

- Permissionless Access: Anyone can download the software, spin up a node to join the network, and see the entire history of transactions.

- Decentralized Governance: There’s no CEO or central authority in charge. The rules of the network are upheld by a broad consensus among its participants, and anyone can help validate transactions.

- Incredible Security: Because they are so massive and geographically spread out, public blockchains are extraordinarily difficult to attack or shut down. This creates an incredibly resilient system.

This “open door” policy makes public blockchains the perfect foundation for applications where maximum trust and censorship resistance are non-negotiable, like digital currencies or transparent voting systems.

Private Blockchains: The Corporate Database

At the other end of the spectrum, you have private blockchains. Picture this as a company’s internal, confidential database. It’s built with the same core ingredients as any other blockchain—cryptographic security and an unchangeable ledger—but access is strictly controlled by a single organization.

This central organization gets to decide who can join the network, what data they can see, and who has the authority to approve new blocks.

A private blockchain is a permissioned network where a single authority dictates who can participate. This setup is perfect for businesses that need to securely share information between internal departments or with trusted partners, all without exposing that data to the public.

For instance, a manufacturing company could run a private blockchain to manage its internal supply chain, tracking parts as they move between different divisions with a verifiable, tamper-proof record that stays completely confidential.

Consortium Blockchains: The Shared Research Group

A consortium blockchain strikes a middle ground, blending the openness of public networks with the tight control of private ones. You can think of it as a shared research project managed by a group of collaborating universities. It’s not open to just anyone, but it’s not run by a single institution, either.

Instead, a pre-selected group of organizations governs the network as a collective. Each member has clearly defined permissions, and they make decisions together about the rules and who else gets an invitation to join. This model is ideal for entire industries where multiple companies need to collaborate and share data efficiently without ceding control to one powerful player.

To make these differences crystal clear, the table below breaks down the key characteristics of each type.

Public vs Private vs Consortium Blockchains

The three main types of blockchain networks each serve a distinct purpose. Public blockchains offer unparalleled transparency and censorship resistance, private blockchains provide control and speed for enterprises, and consortium blockchains enable collaboration within a specific group. Choosing the right one depends entirely on the goal of the project.

| Feature | Public Blockchain (e.g., Bitcoin) | Private Blockchain (e.g., Hyperledger) | Consortium Blockchain (e.g., R3 Corda) |

|---|---|---|---|

| Accessibility | Anyone can join and participate. Fully permissionless. | Invitation-only. Controlled by a single organization. | Semi-permissioned. Governed by a group of entities. |

| Control | Completely decentralized; no single owner. | Fully centralized under one organization’s control. | Decentralized among a select group of participants. |

| Transaction Speed | Generally slower due to complex consensus needs. | Very fast, as validation is handled by fewer nodes. | Faster than public, but depends on the group’s rules. |

| Best Use Case | Cryptocurrencies, public records, voting systems. | Internal business operations, supply chain management. | Inter-bank settlements, industry collaborations. |

Ultimately, the type of blockchain used is less about which one is “better” and more about which one is the right tool for the job. From a global currency to a private business ledger, there’s a blockchain architecture designed for the task.

Real-World Applications of Blockchain Beyond Cryptocurrency

When most people hear “blockchain,” they think of cryptocurrency. But that was just the technology’s opening act. Today, its real potential is unfolding in industries far from the world of digital money.

At its core, blockchain offers a way to create a shared, unchangeable record of… well, anything. This simple but powerful idea is being used to solve complex, everyday problems. From verifying the food on your plate to securing your personal identity, blockchain is quietly building a new foundation for trust and transparency.

We’re moving past the phase of pure speculation and into an era of practical application. Companies are no longer just running experiments; they’re deploying real systems that make supply chains more transparent, data more secure, and ownership clearer than ever before.

Transforming Global Supply Chains

Think about tracking a single head of lettuce from the farm all the way to your grocery store. The traditional process is a mess of separate paper trails and isolated digital records. This creates blind spots—perfect opportunities for contamination, fraud, or simple mistakes to go unnoticed.

Blockchain cuts through that complexity. It creates one single, shared ledger that everyone involved—the farmer, the shipper, the distributor, the retailer—can see and add to in real time. Each time the lettuce changes hands, that transaction is locked in as a permanent block on the chain. The result is a perfect, unchangeable audit trail.

- Food Safety: Retail giants like Walmart are already using this to trace produce. If a foodborne illness breaks out, they can pinpoint the source in seconds, not weeks. This saves produce from being needlessly thrown out and, more importantly, protects public health.

- Luxury Goods: High-end brands are fighting counterfeiters with blockchain. A customer can scan a QR code on a handbag and instantly see its entire history, confirming it’s the real deal.

Securing Healthcare and Digital Identity

Your medical history is probably scattered across various doctors’ offices, hospitals, and insurance databases. This fragmentation makes it nearly impossible for you to control your own health information and leaves it vulnerable to data breaches.

Blockchain offers a fix: secure, patient-controlled medical records. You could grant temporary, specific access to a new specialist, allowing them to see your complete history with your permission. Because the record is cryptographically secured and distributed, it’s exponentially harder to hack than a single, centralized server.

Key Insight: Blockchain is fundamentally about shifting control. It moves data ownership away from big institutions and back to individuals. It gives you a framework to decide who sees your information and how it’s used, whether it’s your medical records or your online identity.

This same principle is behind the push for self-sovereign identity. Instead of relying on a few tech giants to manage all your logins, you could have a single, secure digital identity that you truly own and control. You could use it to access services without handing over troves of personal data every single time.

The Rise of Digital Ownership

Beyond logistics and data, what is blockchain technology doing for creators, artists, and investors? Two of the most interesting developments are Non-Fungible Tokens (NFTs) and the tokenization of Real-World Assets (RWAs).

NFTs are essentially unique digital certificates of ownership recorded on a blockchain. They completely changed the game for digital artists, allowing them to sell verifiable, one-of-a-kind works directly to collectors. But their use cases go way beyond art—think event tickets, in-game items, and even deeds to digital land.

Tokenizing RWAs pushes this idea even further. It involves representing ownership of a physical item—like a piece of real estate, a classic car, or a share in a private company—as a digital token on the blockchain. This makes it possible to own a tiny fraction of something valuable. You could buy and sell a small piece of an office building as easily as you trade a stock.

This move from pure crypto speculation to tokenizing real-world assets is bridging the gap between traditional finance and the decentralized world. Some projections suggest the tokenized asset market could soar past $10 trillion. It’s a massive signal that blockchain is a powerful tool for making illiquid assets accessible to a global market. You can find more on this trend in the latest insights on the future of tokenized assets on trakx.io.

These aren’t just abstract ideas anymore. They show that blockchain is a practical tool with the power to reshape how we verify, own, and exchange value across almost every corner of the economy.

Where Blockchain is Headed (and the Hurdles in its Way)

Blockchain technology is much more than a passing tech trend; it’s a fundamental shift in how we handle trust and value in a digital world. At its core, it promises to overhaul entire industries by bringing in radical transparency, boosting security through decentralization, and cutting out the expensive middlemen that clog up so many processes. But like any powerful new technology, the road ahead is packed with both incredible potential and some serious bumps that need smoothing out.

The excitement is definitely justified. Blockchain offers a kind of mathematical certainty we’ve never had before in digital interactions, creating a single source of truth that everyone can agree on. This is precisely why businesses and governments are diving in, exploring everything from securing global supply chains to building more honest public services. The ability to create trust without a central gatekeeper is its killer feature.

Navigating the Hurdles to Adoption

Despite all the promise, blockchain isn’t a magic wand. A few key challenges are holding it back and actively shaping its evolution. Getting a handle on these limitations gives us a much more realistic picture of where things are going.

- Scalability Concerns: Let’s be honest, many of the big-name blockchains, especially the older ones, can be painfully slow. When the network gets busy, transaction times crawl, and fees can skyrocket. This makes them pretty impractical for high-volume uses like buying a coffee or powering a social media network.

- Energy Consumption: The elephant in the room for years has been energy use. Consensus methods like Proof-of-Work, the engine behind Bitcoin, require a staggering amount of computing power. The environmental blowback has been a huge point of criticism and has thankfully pushed developers to create greener alternatives like Proof-of-Stake.

- Regulatory Uncertainty: Governments around the globe are still trying to figure out what to do with blockchain and digital assets. This lack of clear, consistent rules creates a messy and unpredictable environment for businesses, often slowing down innovation and investment as everyone tries to navigate a confusing patchwork of laws.

The Inevitable Path Forward

Even with these roadblocks, the momentum is undeniable. Interest from both regular consumers and big institutions just keeps climbing, signaling that blockchain-based systems are moving from the fringes to the mainstream. This is especially clear when you look at digital assets.

While blockchain can be applied to almost anything, its role in finance is a great barometer for public sentiment. It’s a technology that is steadily working its way into our collective financial consciousness.

A perfect example is the steady march of cryptocurrency adoption. According to Security.org’s latest annual report, 30% of Americans now own cryptocurrency, a number that’s been surprisingly stable for three years. More telling, 61% of current owners plan to buy more, and 57% of everyone surveyed expect the market to grow. That shows a deep, underlying belief in the tech’s future. You can dig into the full analysis in the latest consumer report on digital security.

Ultimately, the future of blockchain is about solving today’s problems while doubling down on its unique strengths. As developers roll out faster, more energy-efficient networks and regulators finally offer some clear guidance, its power to build trust in a digital-first world will only make it more essential in the years to come.

Frequently Asked Questions About Blockchain

Even as blockchain becomes a more familiar term, it’s totally normal to have questions. The ideas can feel a bit abstract at first, but their real-world impact is undeniable. Let’s walk through some of the most common points of confusion and get you on solid ground.

This section tackles the big questions about security, common mix-ups in terminology, and how you can actually start getting your hands dirty with this technology. We’ll keep the answers straightforward so you can navigate the space with confidence.

Is Blockchain Technology Completely Secure?

While blockchain’s architecture makes it incredibly tough to tamper with, no system is 100% unhackable. The core ledger itself—with all its cryptographic chains and decentralized nature—is exceptionally secure. Trying to alter an existing block on a major network like Bitcoin would require an absurd amount of computing power, making it practically impossible.

However, the weak spots usually pop up in the ecosystem built around the blockchain, not the chain itself. These vulnerabilities often include:

- Smart contract bugs: Code is code, and poorly written smart contracts can have loopholes that get exploited.

- Third-party platform breaches: The exchanges where you buy crypto or the digital wallet services you use can be targets for hackers.

- “51% attacks”: This is a theoretical risk where a single person or group controlling over half the network’s computing power could potentially approve fraudulent new transactions.

So, while the blockchain foundation is rock-solid, the applications built on top of it still demand smart security habits.

What Is the Difference Between Blockchain and Bitcoin?

This is a really common question, and getting the distinction right is key.

Here’s an easy way to think about it: Blockchain is the internet, and Bitcoin is like email. Blockchain is the foundational technology—that shared, unchangeable ledger system. Bitcoin was simply the very first (and still most famous) application built to run on that technology.

Bitcoin is a digital currency that uses a blockchain to let people send and receive money without a bank in the middle. Since it was created, thousands of other applications have been built using blockchain for everything from managing supply chains to securing healthcare data.

Speaking of healthcare, blockchain is being used to protect patient data from breaches, which cost an average of $9.4 million per incident. The market for this specific use is expected to jump from $0.04 billion in 2023 to $11.33 billion by 2030. You can dive deeper into the world of digital security and consumer trends on Security.org.

How Can I Get Involved With Blockchain?

Getting started really depends on what you’re interested in. For most people who aren’t developers, the best way in is to simply start using blockchain applications. This could be as simple as setting up a digital wallet to see how transactions work or browsing a well-known NFT marketplace to understand digital ownership.

For anyone with a technical background, you could learn a programming language like Solidity to build your own smart contracts. Another great option is contributing to open-source blockchain projects—the community is incredibly active and always welcomes new developers.

No matter your skill set, joining online forums and community discussions is one of the best ways to learn from others and keep up with what’s new. The door is open for everyone, from the simply curious to the next generation of builders.

At maxijournal.com, we’re passionate about exploring the intersection of technology, business, and culture. We publish daily articles designed to make complex topics accessible and engaging for everyone. Whether you’re a reader, a prospective author, or just curious about the world, find your next great read with us at https://maxijournal.com.